The ATM Debit-card fee is transparent and easy to understand. This is far preferable to the spate of fees (such as overdraft insurance charges) that were opaque and confounding. If Bank of America wants to charge for a service, they should be free to do so.

Richard Green is a professor in the Sol Price School of Public Policy and the Marshall School of Business at the University of Southern California. This blog will feature commentary on the current state of housing, commercial real estate, mortgage finance, and urban development around the world. It may also at times have ruminations about graduate business education.

Friday, September 30, 2011

Will the private market step in?

Conforming loan limits in San Berardino and Riverside Counties in California will drop from $500,000 to $417,000 tomorrow; in LA and Orange Counties it will drop from $729,750 to $625,500.

So we have a natural experiment in "crowding in." Will the private lending sector fill the gaps?

So we have a natural experiment in "crowding in." Will the private lending sector fill the gaps?

Austerity is a problem, but so is fear

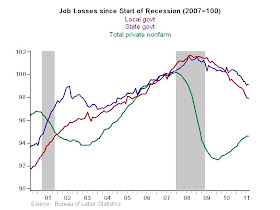

Paul Krugman this morning argues that fear of fear is phony. He is almost certainly correct that fear is not the number one problem at the moment--if I had to pick a number one issue, it would be austerity measures at the state and local levels of government. Tracy Gordon of Brookings has a nice picture:

Cuts in state and local government jobs (police officers, school teachers, firefighters, DMV workers) are putting a drag on employment growth. Moreover, this picture understates the problem, because total compensation to many state and local workers has been cut.

But I do think fear is part of the problem, at least in one sector of the economy. It seems to me that there are business opportunities in lending that are going unanswered. The pendulum for underwriting has swung so far to caution that according to the Flow of Funds Accounts, net lending declined in the second quart of 2011. More specifically, net bank lending dropped by $181 billion on an annualized basis in the first quarter and by $129 billion in the second quarter. Net lending is the difference between volume of new loans and volume of repayment of old loans. I do find it plausible that one of the sources of the tight lending environment is a fear of regulators.

One more point. if it weren't for lending by the monetary authority, net lending in the second quarter would have fallen by $860 billion on an annualized basis.

Cuts in state and local government jobs (police officers, school teachers, firefighters, DMV workers) are putting a drag on employment growth. Moreover, this picture understates the problem, because total compensation to many state and local workers has been cut.

But I do think fear is part of the problem, at least in one sector of the economy. It seems to me that there are business opportunities in lending that are going unanswered. The pendulum for underwriting has swung so far to caution that according to the Flow of Funds Accounts, net lending declined in the second quart of 2011. More specifically, net bank lending dropped by $181 billion on an annualized basis in the first quarter and by $129 billion in the second quarter. Net lending is the difference between volume of new loans and volume of repayment of old loans. I do find it plausible that one of the sources of the tight lending environment is a fear of regulators.

One more point. if it weren't for lending by the monetary authority, net lending in the second quarter would have fallen by $860 billion on an annualized basis.

My friend (and co-author) Andy Reschovsky wins Steve Gold award

It was nice to read about it this morning:

University of Wisconsin–Madison economist Andrew Reschovsky will be honored in November with the 2011 Steve Gold Award, which recognizes a person who has made a significant contribution to public financial management in the field of intergovernmental relations and state and local finance.

The Association for Public Policy Analysis and Management, the National Conference of State Legislatures and the National Tax Association give the award each year in memory of Steve Gold, an active member of all three organizations whose career and life tragically were shortened by illness.

"I knew Steve Gold, which makes receiving this award even more meaningful," says Reschovsky, a professor of public affairs and applied economics in UW–Madison's La Follette School of Public Affairs. "As a public finance economist, Steve believed his role was to communicate to policymakers about research and analysis. His emphasis on the link between scholarship and practice and on policy-oriented work on public finance has very much influenced my career."

Wednesday, September 28, 2011

Boston Fed President Eric Rosengren on the need to facilitate refinances (h/t Kurt Paulsen)

He says at a meeting in Stockholm:

There are several proposals that attempt to facilitate refinancing for homeowners who have been negatively impacted by the drop in housing prices. These proposals do face hurdles, including how to address private mortgage insurance and second liens. However, a program that made it possible for many homeowners to refinance, even if they were upside down, would likely provide significant reductions in mortgage payments to individuals who are likely to have a relatively high propensity to consume. Clearly getting more money into the hands of homeowners who would spend it could help to fuel GDP growth. This would reduce one of the impediments to a more significant effect from the monetary policy actions taken to date.

I hasten to add that there is already a government program to allow underwater borrowers to refinance, the Home Affordable Refinance Program (HARP). This program allows underwater borrowers with Fannie Mae or Freddie Mac loans to refinance at lower rates. Unfortunately, the program has helped fewer borrowers than was originally hoped. Fed Governor Betsy Duke outlined some of the potential reasons why, in the talk I mentioned earlier. They include loan-level price adjustments (LLPAs) that raise interest rates for many borrowers and thereby reduce the benefit of refinancing; originator worries about “buybacks” forced on them by Fannie Mae and Freddie Mac; junior lien-holder resistance to re-subordinating their loans; and mortgage insurance policies.

The Federal Housing Finance Agency (FHFA) is now investigating whether there are ways to enhance the program to benefit more borrowers.[Footnote 15] As this work proceeds, I hope the FHFA considers dropping or reducing LLPAs in cases when a GSE loan is refinanced into another GSE loan. Such a refinance actually reduces the GSE’s credit risk (they already guarantee the existing mortgage and the homeowner will be able to take advantage of lower rates, freeing up cash flow).

Am I posting this because I agree with it? Yes.

There are several proposals that attempt to facilitate refinancing for homeowners who have been negatively impacted by the drop in housing prices. These proposals do face hurdles, including how to address private mortgage insurance and second liens. However, a program that made it possible for many homeowners to refinance, even if they were upside down, would likely provide significant reductions in mortgage payments to individuals who are likely to have a relatively high propensity to consume. Clearly getting more money into the hands of homeowners who would spend it could help to fuel GDP growth. This would reduce one of the impediments to a more significant effect from the monetary policy actions taken to date.

I hasten to add that there is already a government program to allow underwater borrowers to refinance, the Home Affordable Refinance Program (HARP). This program allows underwater borrowers with Fannie Mae or Freddie Mac loans to refinance at lower rates. Unfortunately, the program has helped fewer borrowers than was originally hoped. Fed Governor Betsy Duke outlined some of the potential reasons why, in the talk I mentioned earlier. They include loan-level price adjustments (LLPAs) that raise interest rates for many borrowers and thereby reduce the benefit of refinancing; originator worries about “buybacks” forced on them by Fannie Mae and Freddie Mac; junior lien-holder resistance to re-subordinating their loans; and mortgage insurance policies.

The Federal Housing Finance Agency (FHFA) is now investigating whether there are ways to enhance the program to benefit more borrowers.[Footnote 15] As this work proceeds, I hope the FHFA considers dropping or reducing LLPAs in cases when a GSE loan is refinanced into another GSE loan. Such a refinance actually reduces the GSE’s credit risk (they already guarantee the existing mortgage and the homeowner will be able to take advantage of lower rates, freeing up cash flow).

Am I posting this because I agree with it? Yes.

Monday, September 26, 2011

Hard Choices

Los Angeles (and other large cities) have food deserts--places with limited access to fresh, healthful, relatively inexpensive food. Low-income people living in food deserts are at a particular disadvantage, because they can't afford cars, and therefore often do not have access to supermarkets. A common hypothesis is that poor kids eat unhealthy food because they don't have access to healthy food. (I think this is only partially true--kids also eat unhealthy food because they like it. For that matter, I still love McDonald's fries, I just try to limit my intake, and am in part able to because I have access to better alternatives).

Tesco's Fresh and Easy, a chain that develops and operates small grocery stores that feature fresh fruit and vegetables at reasonable prices, has decided on a business strategy of locating in food deserts. This is potentially a great thing for kids who live in these places (especially if Fresh and Easy can figure out how to take WIC vouchers). But this begs the question of how they are able to sustain such a business model. Two answers present themselves--they are a non-union shop, and they rely heavily on automation. Specifically, Fresh and Easy features self check-out, and so the store doesn't have to hire checkers. Self check-out also makes it hard for Fresh and Easy to accept paper certificates, such as WIC vouchers, as payment.

So the cost of Fresh and Easy is that it may drive down wages for grocery workers a bit, and it may reduce employment for grocery workers. The benefit is that it gives low-income children access to reasonably priced, good quality, fresh foods. My personal social welfare function says to me that feeding kids inexpensively and well dominates most other considerations, but let's not pretend that there isn't a trade-off.

Tesco's Fresh and Easy, a chain that develops and operates small grocery stores that feature fresh fruit and vegetables at reasonable prices, has decided on a business strategy of locating in food deserts. This is potentially a great thing for kids who live in these places (especially if Fresh and Easy can figure out how to take WIC vouchers). But this begs the question of how they are able to sustain such a business model. Two answers present themselves--they are a non-union shop, and they rely heavily on automation. Specifically, Fresh and Easy features self check-out, and so the store doesn't have to hire checkers. Self check-out also makes it hard for Fresh and Easy to accept paper certificates, such as WIC vouchers, as payment.

So the cost of Fresh and Easy is that it may drive down wages for grocery workers a bit, and it may reduce employment for grocery workers. The benefit is that it gives low-income children access to reasonably priced, good quality, fresh foods. My personal social welfare function says to me that feeding kids inexpensively and well dominates most other considerations, but let's not pretend that there isn't a trade-off.

Michio Kaku on CERN's Challenge to Relativity

In this morning's WSJ:

Reputations may rise and fall. But in the end, this is a victory for science. No theory is carved in stone. Science is merciless when it comes to testing all theories over and over, at any time, in any place. Unlike religion or politics, science is ultimately decided by experiments, done repeatedly in every form. There are no sacred cows. In science, 100 authorities count for nothing. Experiment counts for everything.

Thursday, September 22, 2011

A reminder: Ronald Reagan raised capital gains taxes

The Tax Reform Act of 1986 actually did two things that required the affluent to pay higher taxes: it raised the effective tax rate on long-term capital gains from 20 to 28 percent, and it eliminated the ability to write passive losses against ordinary income. This meant that after 1986, Warren Buffett's taxes would have been at least as high as his secretary's.

Tuesday, September 20, 2011

Read Taylor Branch's Atlantic Piece on the NCAA

Let me pull out two paragraphs from the powerful story:

and

But the NCAA system gives these athletes a raw deal. Among other things, the system makes it difficult for athletes in revenue generating sports to get a real college experience--practice and games can leave students too tired to focus on class (yes, I know some athletes have no interest in class to begin with, but in my experience they are a distinct minority). If the "pay" is supposed to be an education, the least we as colleges and universities can do is make sure athletes get one.

Educators are in thrall to their athletic departments because of these television riches and because they respect the political furies that can burst from a locker room. “There’s fear,” Friday told me when I visited him on the University of North Carolina campus in Chapel Hill last fall. As we spoke, two giant construction cranes towered nearby over the university’s Kenan Stadium, working on the latest $77 million renovation. (The University of Michigan spent almost four times that much to expand its Big House.) Friday insisted that for the networks, paying huge sums to universities was a bargain. “We do every little thing for them,” he said. “We furnish the theater, the actors, the lights, the music, and the audience for a drama measured neatly in time slots. They bring the camera and turn it on.” Friday, a weathered idealist at 91, laments the control universities have ceded in pursuit of this money. If television wants to broadcast football from here on a Thursday night, he said, “we shut down the university at 3 o’clock to accommodate the crowds.” He longed for a campus identity more centered in an academic mission.

and

“Scholarship athletes are already paid,” declared the Knight Commission members, “in the most meaningful way possible: with a free education.” This evasion by prominent educators severed my last reluctant, emotional tie with imposed amateurism. I found it worse than self-serving. It echoes masters who once claimed that heavenly salvation would outweigh earthly injustice to slaves. In the era when our college sports first arose, colonial powers were turning the whole world upside down to define their own interests as all-inclusive and benevolent. Just so, the NCAA calls it heinous exploitation to pay college athletes a fair portion of what they earn.I love college athletics (I am thrilled that I have gotten to attend three Rose Bowls in which Wisconsin played) and admire many college athletes. I not only envy their athletic prowess, I am amazed at the varsity athlete who can manage a B average in a difficult major while playing a sport.

But the NCAA system gives these athletes a raw deal. Among other things, the system makes it difficult for athletes in revenue generating sports to get a real college experience--practice and games can leave students too tired to focus on class (yes, I know some athletes have no interest in class to begin with, but in my experience they are a distinct minority). If the "pay" is supposed to be an education, the least we as colleges and universities can do is make sure athletes get one.

Saturday, September 17, 2011

Allowing underwater borrowers to refinance could improve investors' Sharpe Ratio

Consider borrowers with 6 percent 30-year mortgages that are 20 percent underwater. Assume that the probability that any one borrower will default in any one month is .2 percent, and that the cost of default to the lender conditional on default is 50 percent. Assume that at the end of five years, any remaining long balance is paid off). A security containing such mortgages will have an IRR of 4.83 percent (I am happy to share the spreadsheet for the details.

Now let us convert the borrowers into people with 4 percent mortgages with 20 year terms. The payment from such mortgages will be essentially the same as before, and the mortgage balance will be paid off more quickly. The good news for investors is that this lowers the probability of default; the bad news is that it reduces the yield before default. Assuming default probabilities in any one month go down to .1 percent, the IRR for investors goes down to 3.45 percent. This seems like a bad deal for investors, except that they will have more certainty about their cash flows; the standard deviation of their investment falls. Because default is binomial, we can calculate that the variance of returns will be p*(expected loss)*(1-p*expected loss). The variance of not refinancing is thus .0099 and of refinancing is .004975, which translate into standard deviations of .1 and .07. Because the riskless rate is currrently zero, when we substitute into the Sharpe formula, we find

Sharpe no refinance = .048/.1; Sharpe refinance = .0345/.07.

This is about .5 in both cases, suggesting that investors are getting the same risk adjusted return whether refinancing becomes easy of not, assuming the assumptions are correct. I am not saying they are; I am saying that in making policy we need to think about these sorts of implications.

Now let us convert the borrowers into people with 4 percent mortgages with 20 year terms. The payment from such mortgages will be essentially the same as before, and the mortgage balance will be paid off more quickly. The good news for investors is that this lowers the probability of default; the bad news is that it reduces the yield before default. Assuming default probabilities in any one month go down to .1 percent, the IRR for investors goes down to 3.45 percent. This seems like a bad deal for investors, except that they will have more certainty about their cash flows; the standard deviation of their investment falls. Because default is binomial, we can calculate that the variance of returns will be p*(expected loss)*(1-p*expected loss). The variance of not refinancing is thus .0099 and of refinancing is .004975, which translate into standard deviations of .1 and .07. Because the riskless rate is currrently zero, when we substitute into the Sharpe formula, we find

Sharpe no refinance = .048/.1; Sharpe refinance = .0345/.07.

This is about .5 in both cases, suggesting that investors are getting the same risk adjusted return whether refinancing becomes easy of not, assuming the assumptions are correct. I am not saying they are; I am saying that in making policy we need to think about these sorts of implications.

Wednesday, September 14, 2011

Tuesday, September 13, 2011

If the Walt Disney Company ran LA Metro...

People would pay $80 a day to leave their cars in a garage, and then walk from one mode of rail transit to another. And the rail trips would leave you where you started.

Friday, September 09, 2011

Jim Follain has a proposal for empirical macro

He writes:

First, let’s do more research to help reduce the uncertainty regarding the fiscal situation we face and the new, modern and more complex economy in which we live. This step will involve de-emphasizing a number of metrics underlying macroeconomics built around national totals, such as national income, GDP and the aggregate unemployment rate. Instead, we are wise to take a more geographically granular view of our economy that measures regional, state and local economic activity and adapts policies specific to these areas. Focusing upon the national aggregate or the national average masks the extraordinary variation among markets in this country and, indeed, can even make it harder to identify seriously stressful events until it’s too late. This is difficult to do, but c’est la vie.

Tuesday, September 06, 2011

Ten-Year Treasury Below 2 percent!

If I am reading this graph correctly, we are at a 130 year record:

Those bond vigilantes sure are being vengeful. And how about that S&P downgrade?

The good news graph of the day, though, comes from the Fed:

This is the average financial obligation ratio, which is debt service plus rent over disposable income. Lower interest rates do seem to be helping, although it would be useful to know what has happened to the median, as opposed to average, household. I refinanced my mortgage earlier this year, and it was great, and meant my financial obligation ratio fell by ten percent or so. But underwater borrowers who can't refinance (or households whose income fell enough to precent qualification for a new mortgage) may be worse off than before. It is hence possible that while the average has improved, the median has not.

Those bond vigilantes sure are being vengeful. And how about that S&P downgrade?

The good news graph of the day, though, comes from the Fed:

This is the average financial obligation ratio, which is debt service plus rent over disposable income. Lower interest rates do seem to be helping, although it would be useful to know what has happened to the median, as opposed to average, household. I refinanced my mortgage earlier this year, and it was great, and meant my financial obligation ratio fell by ten percent or so. But underwater borrowers who can't refinance (or households whose income fell enough to precent qualification for a new mortgage) may be worse off than before. It is hence possible that while the average has improved, the median has not.

Monday, September 05, 2011

Where are the Medicis when you need them?

Richard White's Railroaded: The Transcontinentals and the Making of Modern America, is a wonderful book. In it he shows how the railroad barons were crooks and swindlers who suckled on the federal teat every bit as much as the deposed yet still wealthy CEOs of failed Wall Street and mortgage firms.

But at least the Huntingtons (well, Collis' nephew Henry, anyway) left us with the Huntington Library and Gardens, an institution that by itself makes a trip to Pasadena worthwhile. And Leland Stanford left us with, well, Stanford. Angelo? Dick? We're waiting.

But at least the Huntingtons (well, Collis' nephew Henry, anyway) left us with the Huntington Library and Gardens, an institution that by itself makes a trip to Pasadena worthwhile. And Leland Stanford left us with, well, Stanford. Angelo? Dick? We're waiting.

Realtors should love school spending

In the most recent Wisconsin gubernatorial election, Realtors and homebuilders were the leading campaign contributors to Scott Walker. As governor, Walker has shown hostility toward public education in general and school teachers in particular. If one were to analyze what ails Wisconsin, public education would not rise to the top of the list, because Wisconsin has among the highest high school graduation rates in the country (or conversely. among the lowest drop-out rates), along with strong SAT and ACT scores. Milwaukee public schools are another matter, but somehow I do not think the school children of Milwaukee are among the top of Governor Walker's concerns.

Beyond all this, however, it puzzles me as to why real estate people would support someone hostile to public education. There is a very long literature that shows that spending on schools produces higher property values, particularly in the suburbs that are the places where Realtors and homebuilders make most of their money. Lisa Barrow and Cecilia Rouse:

… A $1.00 increase in per pupil state aid increases aggregate per pupil housing values by about $20.00, indicating that potential residents value education expenditure."

The Barrow and Rouse paper are not alone in their findings: starting with Wally Oates' seminal 1969 paper through Hilber and Mayer's recent work, the empirical literature finds that school expenditures produce higher property values.

Wisconsin's economy has real problems, among which is a startling poor culture of entrepeneurship: if one looks at venture capital, it ranks very poorly. As such, the children that it educates well leave for other states to find opportunity (despite the stellar performance of its schools, its adult labor force is below average in share of workers with a college degree). But to attack one of the things the state does well--public education--makes no sense. And for Realtors to abet an attack that diminishes their own earning power makes even less sense.

Beyond all this, however, it puzzles me as to why real estate people would support someone hostile to public education. There is a very long literature that shows that spending on schools produces higher property values, particularly in the suburbs that are the places where Realtors and homebuilders make most of their money. Lisa Barrow and Cecilia Rouse:

In this paper we use a 'market-based' approach to examine whether increased school expenditures are valued by potential residents and whether the current level of public school provision is inefficient. We do so by employing an instrumental variables strategy to estimate the effect of state education aid on residential property values. We find evidence that, on net, additional state aid is valued by potential residents and that school districts do not appear to overspend on education. We also find that school districts may overspend in areas in which residents are poor or less educated, in large districts, and in districts with higher shares of rental property. One interpretation of these results is that increased competition has the potential to reduce overspending on public schools in some areas.A money quote from the NBER digest on the paper:

… A $1.00 increase in per pupil state aid increases aggregate per pupil housing values by about $20.00, indicating that potential residents value education expenditure."

The Barrow and Rouse paper are not alone in their findings: starting with Wally Oates' seminal 1969 paper through Hilber and Mayer's recent work, the empirical literature finds that school expenditures produce higher property values.

Wisconsin's economy has real problems, among which is a startling poor culture of entrepeneurship: if one looks at venture capital, it ranks very poorly. As such, the children that it educates well leave for other states to find opportunity (despite the stellar performance of its schools, its adult labor force is below average in share of workers with a college degree). But to attack one of the things the state does well--public education--makes no sense. And for Realtors to abet an attack that diminishes their own earning power makes even less sense.

Friday, September 02, 2011

A point I wish I had made to NPR

I just finished taping an interview with Robert Siegel on finding our way out of the housing crisis. I agreed with Elizabeth Duke about the need to blow out second liens, and with the Hubbard-Mayer-Gross plan to allow current underwater borrowers to refinance easily.

My contribution was that we needed to perform a kind of triage--that places that had massive house price declines and have very high unemployment (i.e., Miami, Las Vegas, Fresno) should get debt relief, lest it take forever for them to recover. What I didn't say (and I wish I had) is that one way or another, many loans in these places will fail, because it will be nearly impossible for borrowers to get above water. We might as well take the pain of the write-offs now, rather than have zombie-loans hanging around.

My contribution was that we needed to perform a kind of triage--that places that had massive house price declines and have very high unemployment (i.e., Miami, Las Vegas, Fresno) should get debt relief, lest it take forever for them to recover. What I didn't say (and I wish I had) is that one way or another, many loans in these places will fail, because it will be nearly impossible for borrowers to get above water. We might as well take the pain of the write-offs now, rather than have zombie-loans hanging around.